Money Matters

Jan 29, 2015

Clever ways to circumvent college costs

College tuition and fees are continually on the rise, so it’s no surprise that many students are graduating with more college debt than ever before. For those Grand Valley State University students who feel helpless and bogged down with student loan debt, here are some clever ways to pay for college and stay out of debt:

1. Work with a service organization. Many universities are affiliated with nonprofit organizations, and students who work for affiliated organizations may be eligible for scholarships provided by the organization and/or the university. Wages for workers who take advantage of such programs tend to be low, but those students who serve full stints could earn scholarships worth several thousand dollars. In addition, students with a desire to give back can find charities that reward workers with college scholarships. For more information on opportunities, visit

www.gvsu.edu/service/.

2. Start a business. Though college kids might not have the time to create the next Fortune 500 company, starting a small business can be a great way for students to earn money and set their own schedules. A tutoring business that caters to local high school students or fellow college kids can be a great way for college students to make practical use of their education. Just a few hours of tutoring each week can be enough to help cover the costs of campus life, and if the business grows big enough, students might even be able to put a dent in their tuition fees. Have a great idea? Go to www.gvsu.edu/cei/ to learn more about competitions and promotion.

3. Live at home. While living at home is an option available only to those students who attend in-state universities within spitting distance of their parents, it’s an increasingly reasonable decision for students worried about accumulating excessive student loan debt. While room-and-board fees vary widely, U.S. News reported that the average charges for on-campus living during the 2013-14 school year were $9,689. Over the course of four years, students will spend nearly $40,000 just to live on campus, and many students will pay those costs via student loans. Students whose primary goal is to avoid substantial postgraduate debt may find that living at home, while not necessarily ideal, is the most effective way to do just that.

Eco-friendly ways to save money- Going green makes financial sense

One of the more popular causes among young people is the green movement. The goal of living a more eco-conscious lifestyle resonates with students on college campuses across the country. For those who have not yet embraced environmentally friendly actions, perhaps the financial rewards of doing so may be the catalyst for change. Here are some ways students can go green, whether in Allendale or Grand Rapids:

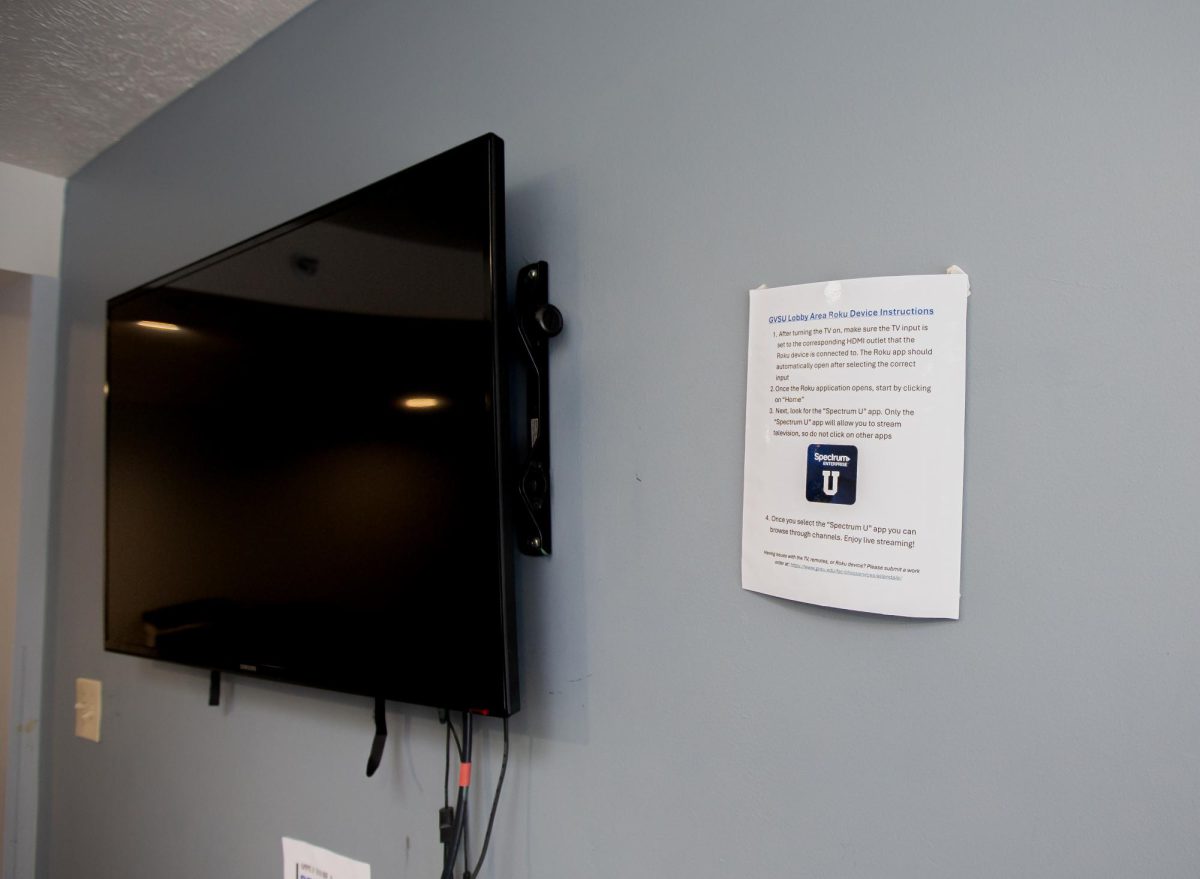

1. Protect your appliances. Cellular phones, mp3 players, tablets, laptop computers, flatscreen televisions and video game consoles might make life more enjoyable, but they also consume a substantial amount of energy, even when not in use. An LCD or LED television that is plugged in, for example, is consuming energy even if it’s not turned on. Instead of plugging televisions and other devices directly into a wall outlet, plug them into a surge protector power strip that can be turned off when you leave your room. This not only protects the devices should a power outage occur, but it also means they won’t be consuming energy while not in use.

2. Choose lights wisely. Many dorm rooms are poorly lit, and students know to bring their own lamps to help them make the most of late-night study sessions. When shopping for a lamp for your room, choose one that’s compatible with compact fluorescent light bulbs, or CFLs. CFLs consume significantly less energy, last far longer than traditional light bulbs and illuminate rooms just as effectively.

3. Buy a water filter. While those mini refrigerators might not be as big as the one back home, they might be able to fit a smaller water filter, saving you money on costly bottled water and reducing your reliance on plastic water bottles. If the refrigerator is less than accommodating, attach a water filter to the sink in your room or kitchen and drink straight from the tap.

4. Make your own coffee. Late night study sessions and late hours spent having fun with friends makes coffee a precious commodity on many a college campus. College kids who want to reduce their carbon footprint, and save a little money along the way, can learn to make their own coffee instead of visiting the local Biggby or on-campus Java City each morning and buying another coffee served up in a styrofoam cup. Purchase a reusable travel mug you can bring along to class and encourage your roommates to do the same.

5. Cook more meals in your room. Convenience meals may be easy, but they’re more expensive than cooking fresh meals for breakfast, lunch and dinner. What’s more, convenience foods tend to be overly packaged and may be shipped great distances. Simply packing a lunch for work or school each day can save you around $100 per month.

6. Carpool. Share your ride to school with one or more people to save fuel, prevent wear and tear on your car and save money. Some calculations paint a savings of around $650 a year for carpoolers who share their ride and gas bill with only one friend. That may be incentive enough to split commuting costs and tasks.

7. Take the bus. If you are more of a commuting loner or do not have anyone nearby to split the ride, try switching to public transportation like The Rapid. Not only will you reduce your carbon footprint by using mass transit, biking or walking to campus, but you will also save thousands on trips that would depreciate your vehicle’s value.

8. Shop smart. So many items are available at the click of a button or by visiting mass retail chains. However, not every purchase is a smart buy – even if it costs less. Some cheap consumer goods are not worth the smaller price tag. They’re produced overseas in areas with lax environmental regulations and then may be shipped thousands of miles. Sometimes buying more expensive, locally-produced items makes better financial sense in the long run. These products will last longer and not need replacing in mere months. One place to check out is the local Fulton Street farmers market, which runs every Saturday this winter. More information is online at www.fultonstreetmarket.org/.