Ethics vs. Economics

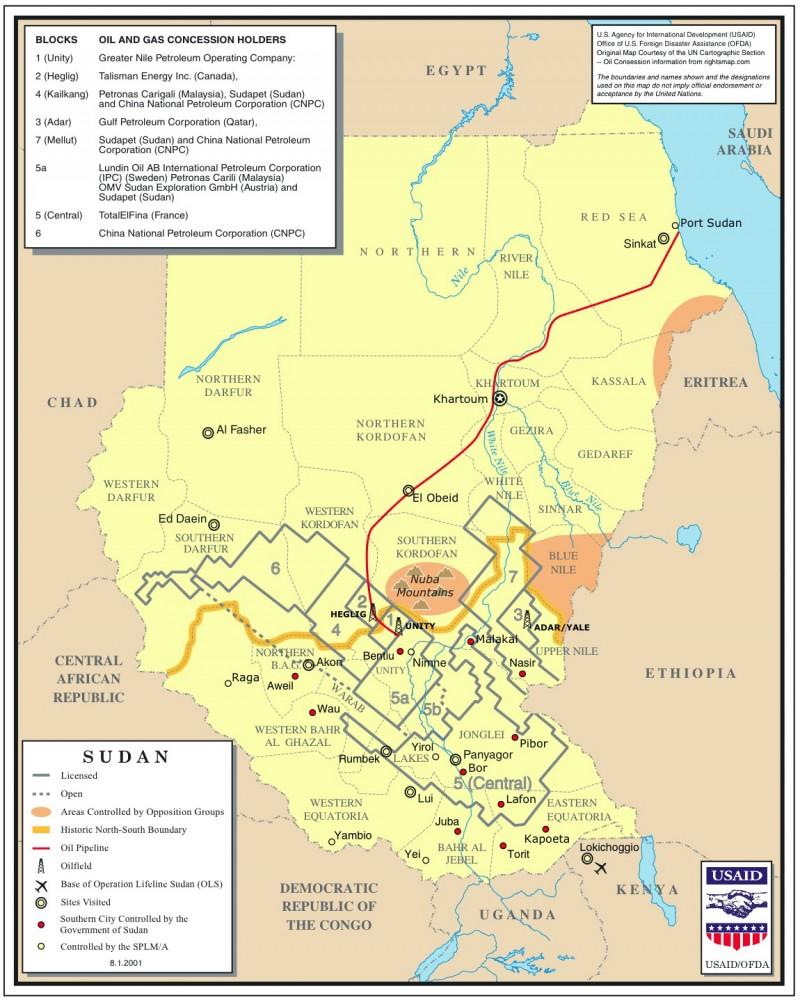

Courtesy Photo / USAID/OFDA Sudan Oil and Gas Concessions Map

Jan 9, 2011

Grand Valley State University is reconsidering renewing its contract with banking conglomerate J.P. Morgan Chase after reviewing research conducted by a group of honors students.

J.P. Morgan currently provides the purchasing cards (P-cards) for GVSU and at least six other colleges in Michigan. J.P. Morgan is one of the largest shareholders for PetroChina, a company that violates human rights through its support of the Sudanese government, said honors student Becca Nixon, who has worked on the research project over the past year.

According to the Hong Kong Stock Exchange, J.P. Morgan held about $1.2 billion worth of shares in PetroChina as of January 2010.

“PetroChina has supported the Sudanese government with funds as well as equipment for the genocide that is going on there,” Nixon said. “Money is power, and they are giving them money.”

While J.P. Morgan has a link to PetroChina and human rights abuses, GVSU’s money probably does not directly finance these operations, said Brian Copeland, assistant vice president for Business and Finance.

J.P. Morgan passes money to PetroChina through mutual funds offered to both individual investors and participants in 401(k) and 403(b) plans, Copeland said. PetroChina is just one company in a collection that comprises a mutual fund. Investors who select a mutual fund containing the PetroChina company will have ownership in PetroChina.

“As you can imagine, investors have different objectives,” Copeland added. “Some like aggressive investments, hoping for a larger than average return, and don’t mind the risk that goes along with it. Others are more conservative and prefer safety over higher returns.”

Money from the P-card program likely does not enter the mutual fund system, Copeland said. Rather, J.P. Morgan sends the funds paid by GVSU to vendors that supplied goods and services acquired through the use of the P-card. These vendors are located primarily in West Michigan.

When Copeland contacted J.P. Morgan for more information, officials at local branches of the corporation had not heard about the conglomerate’s link to the Sudanese genocide. Copeland took his investigation one step further and phoned the heads of J.P. Morgan in New York City. He was given a copy of a human rights policy document published on the J.P. Morgan website.

“JPMorgan Chase complies with applicable international and local legal requirements in the countries in which we operate,” the policy states. “Where local law conflicts with the principles contained in this Human Rights Statement, JPMorgan Chase complies with local requirements while, at the same time, seeking ways to uphold the principles set forth in this Human Rights Statement.”

Even though GVSU may not fund the genocide, Nixon said the university should still end its contract with J.P. Morgan and divest, or pull funds, from the company.

In the first attempt at divestment, the investor asks the company to withdraw from its unjust practices.

“I don’t think we will get J.P. Morgan to take PetroChina out of the offerings in the mutual funds because many investors are selecting mutual funds that include PetroChina,” Copeland said.

If the company does not withdraw, the investors pull their money out of the company. Currently, Copeland is debating how to proceed in a way that will best benefit the university.

“I am confident that, through the use of the J.P. Morgan P-Card, our funds are not ending up in any investment with PetroChina,” he said.

If Copeland decides to change the university’s P-card provider, he will submit a request for proposal and put the P-card contract up for bid. Companies such as PNC, U.S. Bank and Bank of America will likely offer plans and prices, but switching providers causes him concern.

“A lot of corporations have skeletons in the closet,” Copeland said. “And switching P-card providers is a costly process.”

Honors student Sarah Bierlein plans to help make Copeland’s decision about P-card providers a little easier. She will take the reins on the students’ divestment project for the winter 2011 semester and investigate GVSU contracts and investments as part of her honors senior project.

If Bierlein discovers the proposed P-card providers have no ill investments, she said she wants to convince Copeland to sign a new contract.

“Hopefully this will be the main drive to get Grand Valley to realize that we can’t promote things like social injustice,” Bierlein said.

She said she plans to find GVSU written policies about funding socially unjust practices. She plans to hold the university accountable and force it to divest from J.P. Morgan.

If she cannot uncover a policy, Bierlein said she will submit one to explain why GVSU should not invest in such companies, which she hopes the university will enact.

While the contract with J.P. Morgan Chase still waits unsigned, Copeland said he is grateful for the honors students’ time and effort in examining the purchasing card situation.

“I am glad that (they) raised the issue so that we could research the program and make sure that we were not inadvertently investing in PetroChina,” he said.