FEDERAL STUDENT LOAN INTEREST RATES SET TO DOUBLE JULY 1

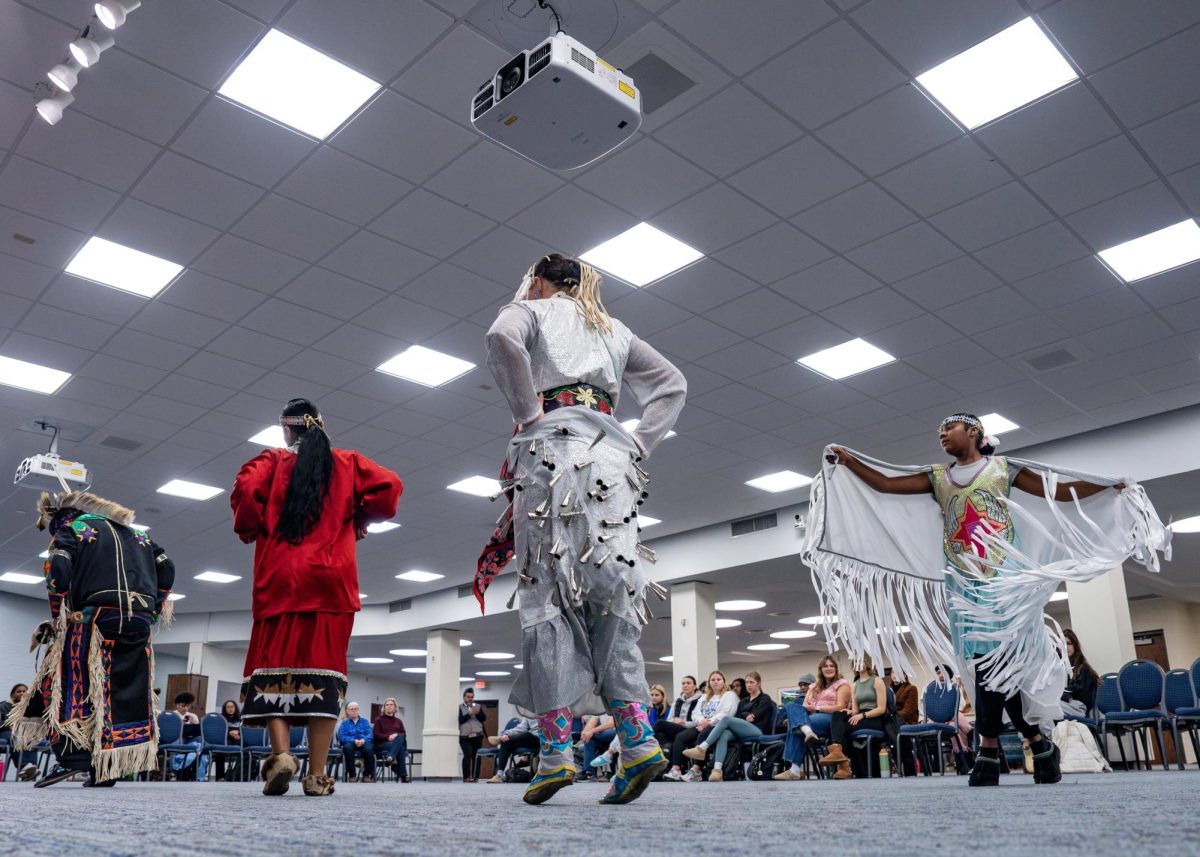

GVL / Eric Coulter Financial Aid Counselor Detwann Johnson helps a student over the phone

May 21, 2012

Despite debates, protests and a Senate vote, interest rates on subsidized Stafford student loans are set to double July 1.

In addition to doubling rates, students would also lose a six-month grace period, during which the holder does not have to pay interest on the loan and interest does not accumulate.

“I need the grade period to find a job, find someplace to live,” said Molly Waite, a senior writing major at Grand Valley State University. “If I had to pay immediately, my parents would try to help, but they’re just as much in debt as I am from medical bills. … I likely won’t be able to find work fast enough to pay back those loans without the grace period. That grace period was part of the reason I chose federal loans.”

According to a release from the White House, the increase would costs students an average of $1,000 in additional student loan debt. A study released in the Federal Reserve Bank’s Quarterly Report on Household Debt and Credit valued Americans’ current outstanding student loan balance at $870 billion, a number that is expected to exceed $1 trillion this year.

“I’m poor — extremely poor,” Waite said. “I plan on going on a poverty diet after I graduate so that I can pay off my loan without having to sell my organs.”

According to data collected by GVSU’s Institutional Analysis, the average “per-undergraduate-borrower cumulative principal borrowed” averaged at $26,912 for GVSU students who earned a bachelor’s degree between July 1, 2010, and June 20, 2011, and borrowed at any time during their enrollment. That number includes Stafford loans as well as other federal and private loan debts.

In 2007, lawmakers passed the College Cost Reduction and Access Act to decrease interest rates on subsidized Stafford loans through 2011.

Although Senate Republicans and Democrats have both expressed a desire to extend the 3.4 percent interest rate on Stafford loans for another year, lawmakers have yet to agree on how to offset the $6 billion it would cost to prevent the rates from rising.

Proposed measures to extend the rate freeze have largely cut from social programs, like a Republican-backed bill in the House that proposes paying for the freeze by cutting from a preventative care health care fund. President Obama has said he will veto the bill.

“This is a politically motivated proposal and not the serious response that the problem facing America’s college students deserves,” a White House statement said.

More than 7 million undergraduates rely on federally subsidized loans to pay for tuition.