Saving money as a college student **PRINT ONLY**

Mar 13, 2018

Head: Tips to save money as a college student

1. Take advantage of the library. Whether they’re public or on campus, libraries offer many useful, free resources to students. One way to save money in college is to borrow required books from the library. Rather than dishing out a hefty fee to pay for books you’ll only use for one semester, check the nearby libraries to see if it’s possible to check out the required text instead. Another cool resource libraries offer is DVD lending so you can watch movies or TV shows for free. This is a good option for students who don’t have access to services like Netflix or Hulu, or for anyone looking to watch something new for no cost.

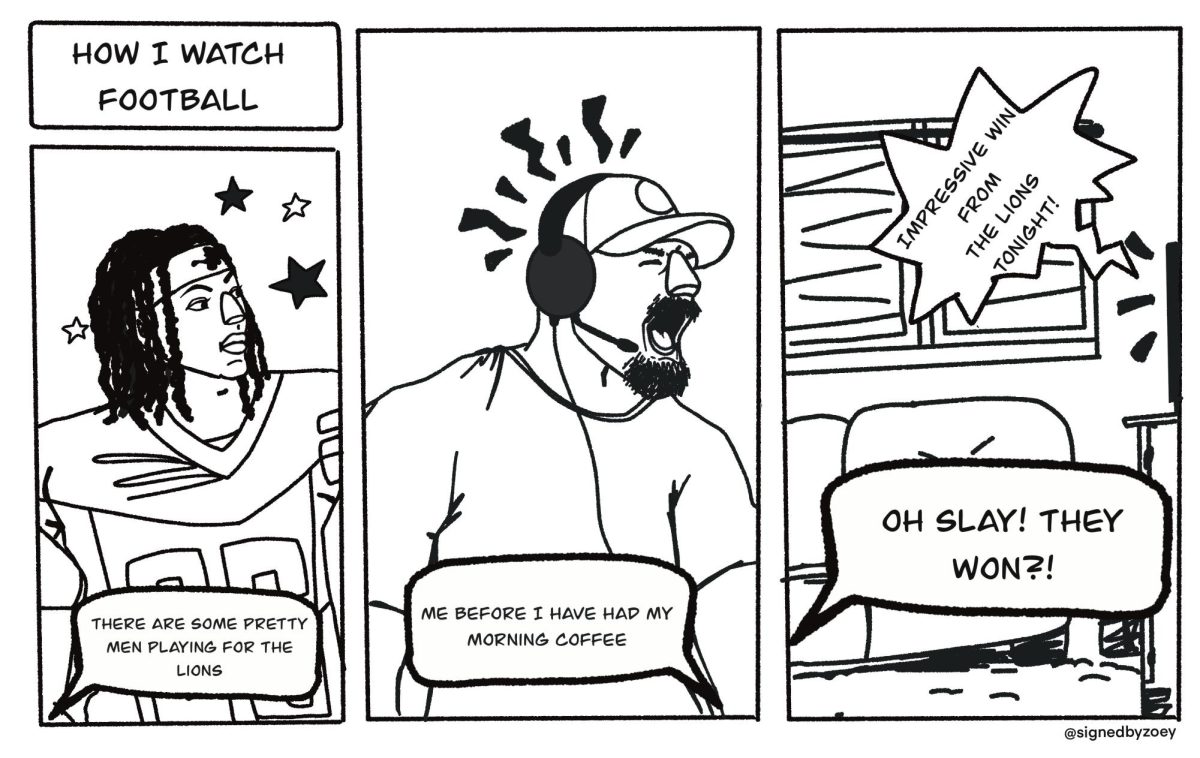

2. Get your caffeine fix without breaking the bank. Coffee is a necessary part of many students’ daily routines and, as a result, something that frequently uses up their extra money. However, there are some options available to save a little coin when you need your caffein fix. For one, all Grand Valley State University campus dining locations offer $1 coffee refills to students. That’s quite a deal when you consider what it costs for just a cup at most places. Even better, at Starbucks, you can grab a free refill on basic coffees and teas in the same store visit (meaning you’ll want to hang out for a bit and get your study on).

3. Go to free campus events. GVSU hosts tons of events that are completely free to students. These events occur regularly and can be easily sifted through by looking at the events calendar on GVSU’s website. Many of these events are educational, but there are also quite a few events geared toward entertaining students, such as comedy shows. Another really great way to have fun without breaking the bank is to head over to the Big Screen Theater inside the Kirkhof Center. Showtimes are offered everyday at 11 a.m., 2 p.m., 5 p.m. and 9 p.m. The featured movie changes every few weeks, so pay attention to the movie schedule (which you can access online under Spotlight Productions.)

4. Hit up the dollar store. The dollar store is a great option for students looking to stock up on supplies or change up their room decor. Offering items at a much cheaper price, the dollar store has notebooks, pens, pencils, dishes, candles, cleaning supplies and more. Many times, too, dollar stores offer coupons that are accessible online. Cutting coupons (though tedious) is never a bad idea, especially when it has the potential to save you even more money. For students interested in shopping cheaper, there is a Dollar General located a little over a mile away from GVSU’s Allendale Campus.

5. Eat out selectively. This can be a hard rule to follow, especially for students who go straight from work to school and vice versa. The day can feel super short with so much going on, and cooking a meal at home becomes a luxury many students cannot afford. Not only are groceries expensive, but finding the time to make a meal that isn’t ramen is challenging for the best of us. However, when considering how much of your money is going toward eating meals out, eating in becomes the clear choice for saving extra dough. One good way to save yourself both time and money is to meal prep, or make meals in advance and refrigerate them to eat throughout the week.

6. Save your change. This can be an extremely awarding activity when all is said and done. Designate a jar—or go old-fashioned with a piggy bank—and put away all your spare change. This is not something that will generate $100 overnight, but if you continue to lock away any extra money you have lying around, eventually you’ll have something to show for it. You can even give the at-home bank a greater purpose if that helps: Make it “vacation fund” or a “concert ticket fund” to motivate yourself to keep saving. Once the jar has reached its capacity, take it into your bank or visit a Coinstar machine. One tip when using Coinstar is to choose an e-gift card rather than cash, as Coinstar takes 11.9 percent of the value of the coins you’re exchanging.

7. Always ask about a student discount. So many places offer a reduced rate to students, and many don’t outwardly advertise it. For this reason, always be sure to inquire about student prices. This can make a big difference in saving money, whether it be a few dollars here and there or a lot all at once. In addition, always be sure to do some research beforehand; if you’re looking to buy something like a laptop, be sure to look at which store offers a better student discount and compare the final numbers. Looking at products and services comparatively will always ensure you get the best deal in the end. Many restaurants and retail shops offer a student discount, too, in addition to online services like Amazon.com, iTunes, Spotify and Hulu, so be sure to take advantage of it.

8. Utilize the bus system. GVSU has a great bus system for students, which not only is convenient, but it also saves you from putting miles and wear and tear on your car. With gas prices always rising, it’s a good idea to conserve what’s in your tank any chance you can. With a service like The Rapid, GVSU students can get to both the Allendale and Pew campuses for free. Not only that, but when it’s headed to GVSU’s campuses, the bus can get you closer to your class than driving and parking would. That saves students time and a little extra walking—a big deal considering Michigan’s still-cold temperatures this time of year.

9. Learn to budget. Learning how to create a budget and follow it is essential in life, and starting this habit in college will set you up for financial success later in life. One way to start setting up a budget is to give yourself a spending limit. Many credit cards are set up with a spending limit to ensure you don’t go over a certain amount or spend more than you have available. However, if you have a card with an unlimited spending limit, this responsibility ultimately falls in your own hands. Determine what amount makes the most sense according to your income and expenses, and then break it down further into categories. Having strict budgetary guidelines will only encourage positive spending habits down the road.