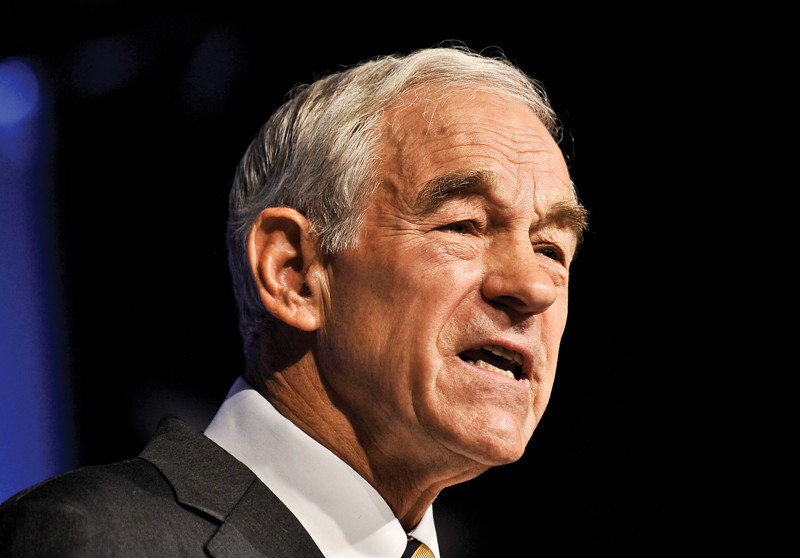

Professor reflects on Ron Paul’s Hudsonville visit

GVL / woodtv.com GOP Ron Paul

Mar 12, 2012

Following Texas Rep. Ron Paul’s pre-primary visit to Hudsonville, Mich., Grand Valley State University economics department chair and professor Paul Isely said both students and schools would have to make significant adaptations

if Paul is elected and goes through with proposed measures such as eliminating the federal Department of Education, subsequently eliminating student loans.

“The expectation would be that it would increase cost,” Isely said.

However, this increase in cost of attendance would lower the student population and force schools to change their ways.

In an article in the American Bar Association Journal, published this past December, authors wrote that the legal world is taking a very serious look at what they have deemed “the law school bubble.” Undergraduate and professionals schools are part of the larger “school bubble” which will, as the housing bubble did, eventually burst. This will result in a correction one way or the other.

As a whole, the U.S. student debt now totals at $1 trillion, none of which can be erased if a person declares bankruptcy. Eventually a correction will occur, but how it will occur is the question that remains.

“The other major problem we have faced these last five years is the inability of politicians to allow the correction to occur,” Paul said. “When mistakes are made you’re supposed to have a correction.”

Isely responded to Paul’s proposals.

“If he got everything he wanted, you should expect a recession in 2013-2014,” Isely said.

However, as Isely sees it, this temporary pain would most likely lead to better investments. Although Paul’s plan could lead to another recession, it would seem that another recession is already in the cards. The New York Times reported on it in August 2011.

“There’s a lot of credibility in that argument,” Isely said.

Among other issues discussed at the Hudsonville rally, Paul mentioned allowing 25-year-olds and “under the ability” citizens to opt out of Social Security, which would free up their money to be spent in more lucrative ways to help stimulate the economy. Generations already dependent on Social Security would not have to worry about their coverage being cut, as individuals between the ages of 26 and 64 would still be contributing to Social Security.

Although it may not seem like a pressing issue to most college students, Social Security, originally an optional program, evolved into its current form that in a report released by the Congressional Budget Office, has been decried as “broke.”

Instead of taxing people for Social Security and having that money eventually lost through inflation or mismanagement, much like Paul’s “token cut of one trillion dollars,” the opting out of Social Security would work much in the same way.

“It would be that the government would quit spending it, and the people would spend it,” Paul told rally attendees.