Student debt relief plan sparks further debate at GV as application goes live

Oct 24, 2022

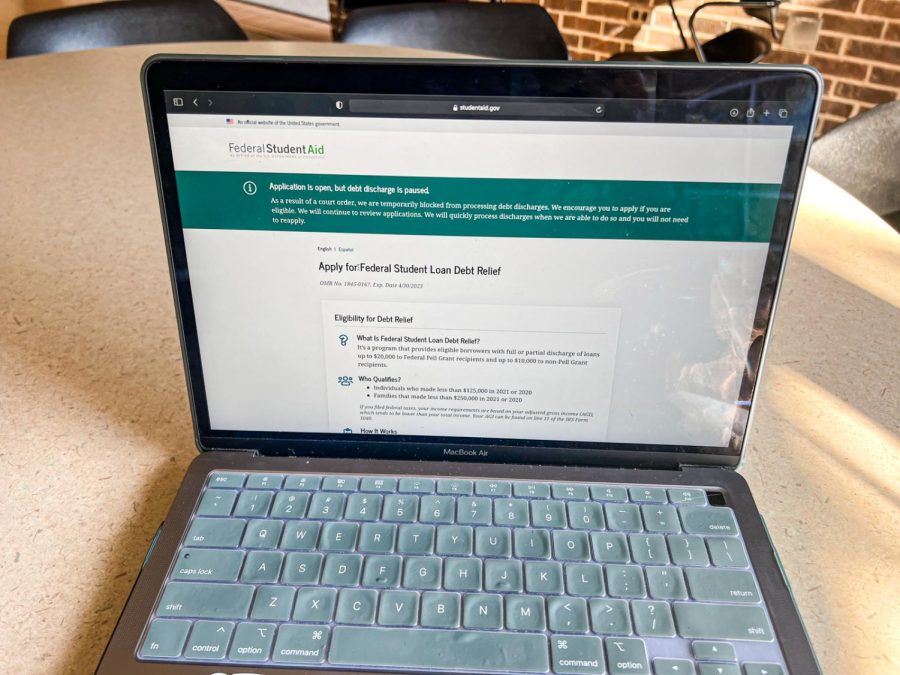

The Biden-Harris administration made an announcement in August of a one-time student loan debt relief plan that provides student loan borrowers the opportunity to be relieved of up to $20,000. On Oct. 17, the Department of Education’s Federal Student Aid made the first version of its application for the relief available to borrowers.

The opening of this application has sparked differing opinions about the plan among Grand Valley State University students and community leaders.

“More than 40 million borrowers stand to benefit from the plan, with 15 million borrowers holding less than $10,000 in debt,” said GVSU Political Science Professor Michelle Miller-Adams. “Many of these people have been repaying their loans for years, sometimes decades, with interest rates and fees making it impossible for them to pay off their balances. Getting clear of this debt burden will make a huge difference in their lives, freeing up resources to spend on other things.”

The sizable amount of student loan debt forgiven could provide relief for people who need it.

“There is a lot to love about this plan,” Miller-Adams said. “It balances multiple priorities in the interest of giving the maximum number of students a reasonable amount of relief. I especially like the larger amount of relief for Pell Grant recipients, which effectively targets more relief for lower-income students. And the high-income ceiling for eligibility means the program will reach most borrowers while screening out the truly affluent.”

The expense of providing student loan relief to so many people has been a major point of criticism from the plan’s opponents. The non-partisan Congressional Budget Office has estimated that the plan will cost $400 billion.

However, Miller-Adams said that the people who are the least advantaged will gain the most from this plan.

With many struggling with the burden of inflation, the student loan relief plan can lift some weight off people’s shoulders.

“It’s going to provide a lot of relief for graduates who may be struggling to find a job with equivalent pay for their education levels,” said Natalie Bremmer, a GVSU junior and finance major working at the Van Andel Global Trade Center. “These forgiven loan payments will allow them to offset the rising costs of groceries, housing and transportation, and slightly improve quality of life as an increase of income (or decrease in bills) tends to do.”

While positive aspects of this plan have been touted by many, critics have emphasized that negative effects do, indeed, exist.

“It’s going to give people incentive to borrow more money than they can really handle,” Bremmer said. “In the short term, it’s going to lessen the debt. In the long term, people are going to borrow more than they can handle with the assumption that it’s going to be fully or partially forgiven, and if they don’t qualify, they will end up with a lot more debt than they anticipated, which will cause student loan debt totals to increase substantially.”

The plan may cause people to bite off more than they can chew because they may believe that their loans will be forgiven by the government, despite the reiteration that this plan is a one-time deal and only applies to loans taken out before June 30 of this year.

“Of course these programs have good intent, and in the short term, this has the potential to provide relief for a lot of Americans, but it’s absolutely going to do a lot more long-term harm than it will do good,” Bremmer said.

As to the program’s rollout this week, the process has been heralded by advocates as being relatively successful.

“It is important that the application process works smoothly,” Miller-Adams said. “So far, so good. 8 million borrowers applied for the program during its ‘soft launch’ over the weekend, and the application process is extremely simple. This kind of effort can help build trust in government and strengthen public confidence in our institutions. More of that is a good thing.”

Following a federal appeals court ruling on Oct. 21, the plan has been temporarily blocked from relieving any student debt. However, the administration has continued accepting applications for relief during the hold.

Those who wish to apply and are eligible can visit studentaid.gov to begin their application.